PNC expects the transaction to be approximately 21% accretive to earnings in 2022 and to substantially replace the net income benefit from PNC's passive equity investment in BlackRock that was divested last May.

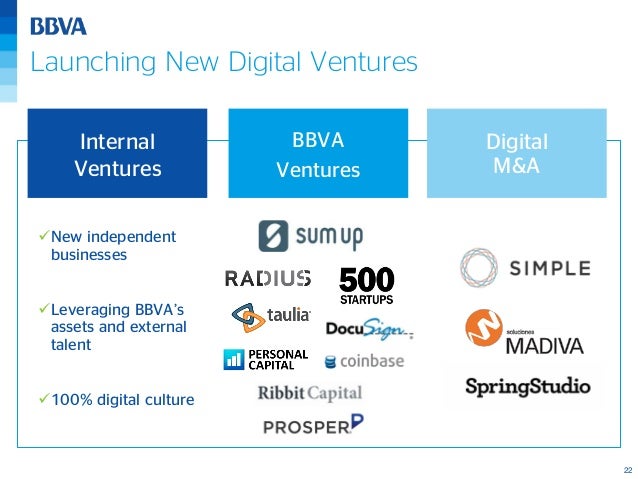

Said PNC CEO William Demchak, "Our acquisition of BBVA USA will accelerate our growth trajectory and drive long-term shareholder value through a strategic deployment of the proceeds from the sale of our BlackRock investment." Having been approved by both companies’ boards, the deal is expected to close in mid-2021, with PNC as the surviving entity absorbing BBVA USA Bancshares and BBVA USA merging with PNC Bank. The price represents almost 50% of BBVA’s current market capitalization. banking acquisition since the 2008 financial crisis, according to Reuters, and values the American business at 19.7 times its 2019 earnings and 1.34 times its book value as of September 2020. The all-cash deal is the second-largest U.S. The new company will have a coast-to-coast presence in 29 of the 30 largest markets in the U.S., PNC said Monday. Headquartered in Houston, BBVA USA Bancshares has $104 billion in assets under management, with banking subsidiary BBVA USA operating 637 branches in Texas, Alabama, Arizona, California, Florida, Colorado and New Mexico.

business, BBVA USA Bancshares, to Pittsburgh-based PNC Financial Services Group (NYSE:PNC) for $11.6 billion, the latter firm announced Monday. Spanish financial group BBVA has agreed to sell its U.S.

0 kommentar(er)

0 kommentar(er)